“All-electric by 2030.” It’s a line that you’ve heard or read dozens of times in the last few years. Politicians, automakers, and even regulatory committees made bold proclamations about the sweeping reform that EVs – and, often unmentioned, hybrids – were bringing to the world. Then, a weird thing happened. 2025 started knocking, and almost as uniformly as they were announced, these goals were quietly rolled back. You won’t see that tagline attached to BMW, though. When it became all the rage to announce the death of the internal combustion engine, BMW remained noncommittal.

Today, BMW’s electrification strategy remains more or less the same as when widespread electrification started catching on. There are two key components that every manufacturer zeroes in on: the status of ICE (internal combustion), and their in-brand share of EV sales. The first part of that is perhaps the most interesting, as many other manufacturers have concluded what BMW realized years ago: that continued commitment to the gasoline engine is necessary. BMW has no end in sight for ICE production. “We will stay flexible—even well into the 2030s,” to quote CEO Oliver Zipse.

The next component that automakers are primarily concerned with is how many electrified vehicles they can push into their customers’ hands. According to the last reported sales data (Q2 2024), 22 percent of BMW’s global sales during 2024 have been electrified vehicles. That number includes BEVs and PHEVs. Perhaps that’s why BMW – currently third in the world for EV sales in 2024 behind Chinese manufacturer BYD and ubiquitous Tesla – is still holding on to its goal of 50 percent fleet electrification by 2030.

The Flexible BMW Strategy Paid Off

BMW’s been in the electric market segment longer than most people give them credit for – technically, since 2009 with the MINI E. Since nobody seemed to care about the underrated and extremely competent BMW i3, BMW attracted some ire when competitors beat them to the punch with what journalists appeared to consider a “real EV.” Mercedes-Benz beat them to market with the EQC, and Audi’s e-tron predated the iX and i4 by a couple of years. There are caveats, of course; the EQC never made it to the US and lived a short, four-year production cycle. The e-tron is still around, currently kicking it at #14 in Car and Driver’s Best luxury Electric SUVs. There’s a lot of irony in what you’ve just read, so make sure you’ve soaked it all in.

OEMs Are Altering Their Future Plans

Today, it’s not unfair to classify BMW as the electrified king in the Clash of the Teutons. As automakers like Mercedes-Benz pivot their strategies to right the ‘sinking’ EV ship (it’s not), you have to stop to ponder: how, exactly, did BMW come out on top? First off, they had significant data. BMW had plenty of hands-on experience with real premium-segment EV buyers and offered a premium EV product – which Mercedes off-shoot Smart certainly didn’t do. From the fledgling MINI E and BMW Active E came the BMW i3, which set up the BMW iX for its best shot at success. Furthermore, BMW had already invested significantly in an electrified future, whereas many other automakers needed to justify enormous cash infusions to get the ball rolling. With those capital commitments, a grand and shareholder-appeasing gesture is almost mandatory. All aboard and all-electric by 2030.

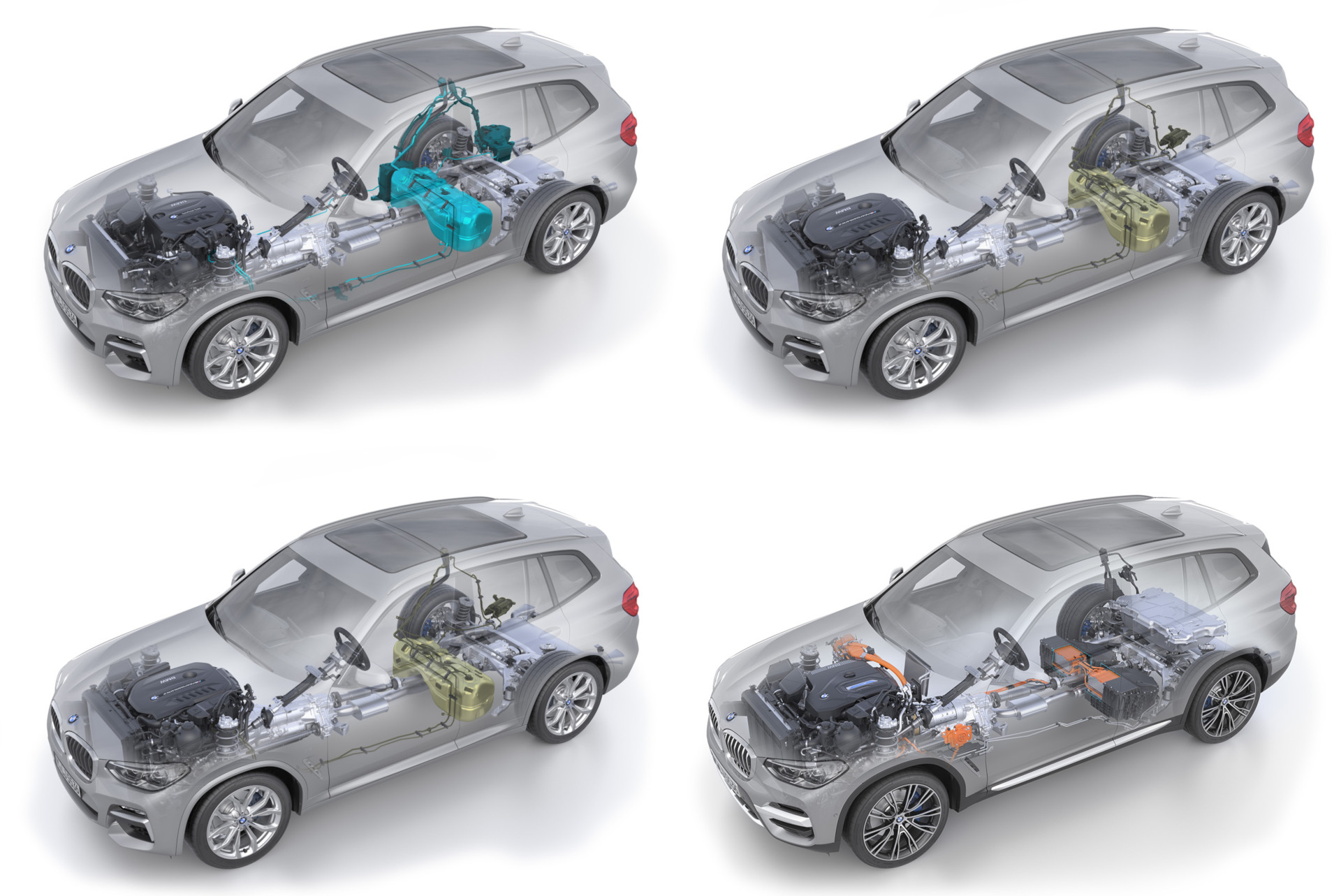

BMW kept things flexible, too. In a world where nearly everyone claimed that EVs were the only way to go forward and dedicated platforms were a necessity, BMW (and strange bedfellow Toyota) continued to focus on a mix of hybrid, electric, gas, and even hydrogen vehicles, thanks to its Cluster Architecture (CLAR). Like some other manufacturers, Mercedes will be phasing out some of their standalone EVs in favor of a more flexible lineup that looks and feels more ‘normal.’ So, more i5 to 5 Series than Honda Clarity or Chevy Bolt.

All-Electric By 20 – Just Kidding.

BMW’s strategies paid off, and it’s fine that we won’t see an all-electric lineup in 2030. Their goal of hitting 50 percent global EV sales by 2030 – with or without counting PHEVs – is still lofty. A BMW report from 2022 targets over 30 percent of sales by 2025, which feels far away from today’s 22 percent. But when you consider the anticipated launch of Neue Klasse and a seriously diverse portfolio of existing products, it doesn’t seem completely out of grasp. Besides – they’ve already proven us wrong once. Let’s not go two for two.